Part 1. Introduction

Financial hurdles and quarrels can damage even the best business partnerships, ventures, and friendships. Whether you are a business owner, a freelancer hoping to receive their long-forgotten income, or a friend helping out another, having a properly documented repayment plan is incredibly important.

That is where the very useful payment agreement comes in! Using a payment agreement template and building a payment agreement ensures you have a legally binding contract that mentions the terms and conditions of financial obligations for all parties involved.

It represents the parameters for receiving and sending funds, ensuring that every party knows their responsibilities and rights.

Additionally, a payment agreement contract spells out the exact amount involved and the deadline for payment. It also establishes a clear record, protecting both the payee and the payer. So, if a dispute arises, the document stands tall as proof of the agreed terms.

Therefore, creating a well-defined and structured payment agreement template is really important. While so many free payment agreement templates are available on the web, knowing which one can do the job well can be overwhelming.

Additionally, when considering payment agreement templates, the basics that you want to cover include these two: general payment agreements and Specific payment agreements.

You want to ensure that your selected template offers these two segmentations so you have all the features and options to create your agreements effortlessly according to your needs or circumstances.

In light of all this information, we’ll explore the different types of payment agreement templates available in this article and cover the details concerning a simple payment agreement template, a payment plan agreement template, and even a commission payment agreement template.

If that’s what you’re here to look for, then you’re in luck!

Part 2. Simple Payment Agreement Template

Let’s kick this list of templates off with the simplest of contracts – the simple agreement template.

This template is a pre-formatted and structured document highlighting the key terms of payment for whichever reason you need the contract. It mentions the payment schedule (how much and how often), the amount owed, and the exact date for full repayment.

What Makes a Simple Payment Agreement Template Useful?

Yes, it may appear convenient to reach a verbal agreement. But what happens if life throws an unexpected twist or recollections become cloudy, resulting in missed payments? A simple payment agreement template offers a safety net with the following advantages:

- Specificity and Clarity:There can be no ambiguity! The due date, the payment plan, and the outstanding amount are all specified in detail in the form.

- Coverage for Both Parties:It creates a formal contract record that serves as evidence for the payer and the payee (the individual who receives the payment).

- Decreased Misunderstandings:Misunderstandings are less likely when there is a formal agreement.

- Simplified Collections (If Needed):A formal agreement helps your case if things go wrong and collections are required.

What are the Key Elements of a Simple Payment Agreement Template?

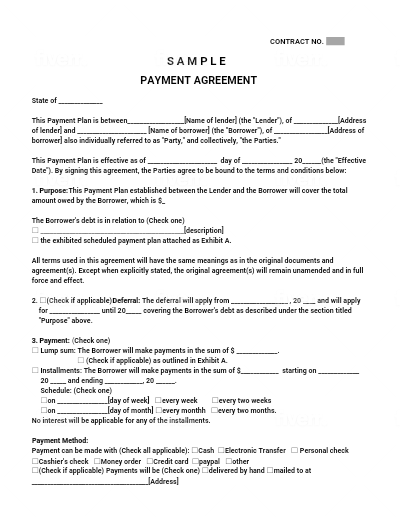

Most templates follow a similar structure, typically including:

- A title that clearly states it's a Payment Agreement, so there’s no ambiguity. The same clarity goes for the rest of the articles in the contract.

- Names and contact information of both the payer and payee.

- The date the agreement is made.

- The total amount of money to be repaid.

- How often will payments be made? If the payments will be made monthly, you can consider using a monthly payment agreement template. Please note that every other aspect of the contract will remain the same.

- The date by which the debt must be fully repaid.

- A proper space for both parties to sign, accept, and understand the agreement.

Various Uses of Simple Payment Agreement Templates

Simple agreement templates are often relegated to collecting overdue payments or formalizing loans between friends. But these handy documents hold immense potential for a variety of situations!

- Lending Money to a Friend: Suppose you're the giving kind and give your friend a loan. A payment agreement establishes a plan and guarantees that customers know the exact amount they must repay, preventing later tricky situations.

- Freelance Work:If you work for yourself, you should have a payment agreement with your customer that specifies the project cost, the mode of payment you like, and how to pay (e.g., in advance, milestones, upon delivery).

- Paying Off Debt: You may have taken out a loan from a relative. A repayment agreement templatecreates a precise payback contract and demonstrates a commitment to repaying the debt.

- Selling Personal Property: Let's say you want to sell your car. Know that there's a template for that. You and your customer can lay out the property's financing with a private vehicle payment agreement template.

Also, if there are installations involved, your car payment agreement templatewill mention the installment plan, any down payment made, and the total amount outstanding.

Customizing Simple Payment Templates to Your Needs

The beauty of simple agreement templates lies in their customizability. Most templates come pre-populated with standard clauses, but you have the power to:

- Add Specific Details:Flesh out essential details relevant to your situation. For a project outline, include specific tasks and deadlines. In a barter agreement, the exchanged services should be clearly defined.

- Refine Clauses:Be bold and tweak existing clauses. Adjust the language for a house rule template to reflect your specific expectations.

- Include Additional Provisions:Do you need clauses not covered in the template? Add them! For instance, for equipment rentals, consider including a clause for wear and tear.

- Delete Unnecessary Clauses:Only some things in the template might be relevant. Remove clauses that don't apply to your agreement.

When customizing a simple payment agreement template word, keep the language concise and easy to understand for all parties involved.

You can use a tool to maximize efficiency in this regard as well. Microsoft Word is a good option, but if you want to keep it in a more viable format, we suggest converting and using a PDF.

To edit a PDF, the AfirstsoftPDF is a great tool! It helps you add more structure to your legal docs, allows you to practice constant revisions for further usage, and allows you to customize and personalize the document as you wish.

Side note: While simple agreement templates are great for basic agreements, consulting a lawyer is highly recommended for situations with significant financial implications or complex legal considerations.

Part 3. Payment Plan Agreement Template

Consider a paper detailing an organized and transparent debt payment plan. Take a deep breath of relief! These templates are your go-to tool for encouraging effective communication and creating a situation where everyone wins.

How to Use It: Constructing an Organised Payment Schedule

A payment plan agreement template offers a structure for drafting an official repayment schedule. This plan specifies the amount owed, the frequency and amount of payments, and the last payment deadline. It serves as an agenda, ensuring everyone agrees and preventing misunderstandings.

Crucial Elements: The Foundation of Your Contract

What, therefore, defines these potent templates? Now, let's examine the essential components:

- Entities Concerned:Both the debtor, who is the one making the payments, and the creditor, who is receiving them, should be identified. Provide their contact details and their names.

- Amount Owed:The total amount that needs to be paid back is indicated in this section. Provide specifics and mention any fees or interest that may apply.

- Payment Schedule:This is where everything is put in order. Indicate in detail the cost of each installment and the frequency of payments (such as monthly or biweekly).

- Deadlines:Give each payment a specific deadline. This keeps the debtor on track and prevents confusion.

- Late Fees (Optional):Although this portion is optional, it may be an effective disincentive for late payments. Specify any penalties or late charges that will be applied.

- Signatures:Both parties must sign and date the agreement to indicate their comprehension and acceptance of the provisions.

Customization Is Essential

The capacity to customize payment plan templates is what makes them so attractive. While most templates offer a robust framework, you can modify them to meet your unique requirements.

- Include Particular Information:Give specifics that are pertinent to your case. For instance, you may outline a freelance contract's revision processes and deliverables.

- Refine Clauses:Feel free to make changes to already-existing clauses. You can modify the wording of house rules that roommates create to reflect particular expectations.

- Include Any Other Requirements:Do you need clauses that the template does not address? Put them in! For example, consider including a wear and tear clause in equipment rentals.

All in all, templates for payment plan agreements are more than just instruments for collecting debt.

They encourage trust, open communication, and financial concord. Creating a formal, recorded repayment plan can prevent misunderstandings and pave the way for a positive conclusion.

Part 4. Commission Payment Agreement Template

When a company or individual—typically a salesperson—sells to or introduces customers to a third party, they use a commission payment agreement template. After that, they'll get paid a commission for the introduction or sale.

Commission-based sales generation is a fantastic supplementation method, but you must ensure that your income streams and rights are safeguarded. Therefore, a commission payment agreement template is necessary to formalize this interaction.

Uses of Commission Payment Agreement Templates

According to this agreement, the company, as one of the parties, hires an organization or person as a middleman whose job is to locate a potential investor to help the business reach its fundraising goals.

A predetermined portion of the money the business earns from investors is given to the introducer in exchange. Not only that, but a percentage-based compensation may also be included in a sales, marketing, or distribution agreement.

The marketing and sales agreements are recurring, meaning a commission is given for each sale. You want to lay down everyone's obligations and privileges because you're hiring a new worker who will be paid entirely or partially on commission.

Critical Components of a Commission Payment Agreement Template

- Company:The company chooses the agent and grants him either non-exclusive or exclusive rights. This section contains the essential details regarding the type of work or the reason the commission contract is being entered into.

- Duties:This section outlines the agency's obligations and, if applicable, the workers.

- Insurance:The agent shall maintain liability insurance under this section.

- Benefits and compensation:These will comprise the terms and conditions that apply to this agreement as decided upon by the parties.

- Expenses:The commission agreement will specify the costs for which the agent or employee will be compensated.

- Term: The agreement will expire within that time if the terms are not renewed.

- After termination: The worker must not divulge proprietary information about the business, and the employer may not restrict the worker's rights.

- Entire Agreement:All previous discussions among the parties are superseded by this agreement, which contains the parties' entire understanding and agreement regarding the subject matter included here.

This agreement may not be changed or amended, nor may any rights under it be waived, unless the party to be charged signs a written amendment.

Similarly, any future modifications to the Agent's responsibilities or commission will not impact the lawfulness and scope of the agreement.

- Severability:This Agreement's remaining provisions shall remain in full force and impact even if one or more are illegal.

- Attorney Fees:Who will pay the legal costs if the agreement is sued?

- Further Acknowledgments: The parties acknowledge and agree that:

- They are signing this agreement voluntarily, free from coercion or undue influence.

- They have carefully read it and have asked any questions necessary to understand its terms, consequences, and binding effect entirely.

- Before signing, they have, if needed, sought the advice of a lawyer of their respective choosing.

- Confidentiality: The employee shall not divulge to any third party any confidential information, records, or knowledge relevant to the Company's operations, both during the term of this agreement and thereafter as mutually agreed upon.

- Waiver:Any party's failure to enforce any element of this agreement will not be interpreted as a waiver or restriction on that party's ability to enforce later and require strict adherence to the terms of this Agreement.

Part 5. Conclusion

That’s the end of our guide on Payment Agreement Templates. We’re sure you must now be aware of how valuable these templates are when navigating the world of money.

Always remember that these versatile tools go far beyond chasing overdue invoices. They can be your secret weapon for fostering clear communication and building solid financial relationships in various situations.

We explored a simple payment agreement template, one based on a payment plan, and also considered in detail commission payment agreements. Most importantly, we unlocked the power of customization, empowering you to tailor templates to your needs.

So, the next time you encounter a financial agreement, don't hesitate to use a payment agreement template. With some understanding and customization, you can transform it into a powerful tool that safeguards your interests and promotes financial harmony. Let us know how using it works out for you!