The investment arrangement template provides an organized way of documenting partnership terms between two people. The template is designed to guarantee that the investors as well as the company that is receiving the funds are fully aware of the roles they play and their responsibilities.

- 100% secure

- 100% secure

- 100% secure

A well-written arrangement for investment is essential for both the parties either its investment agreement template word or investment agreement template PDF. For investors, it clarifies the terms they will receive as a reward for their investment and includes details such as equity ownership as well as the timeframe to receive their returns. The business's document defines the terms on that they will get the investment. This helps with organizing and managing funds efficaciously.

Utilizing investment agreement template helps save time as well as assures that the most important aspects are in place. It also reduces the chance of disputes or miscommunications later on, which makes the entire process easier and clearer.

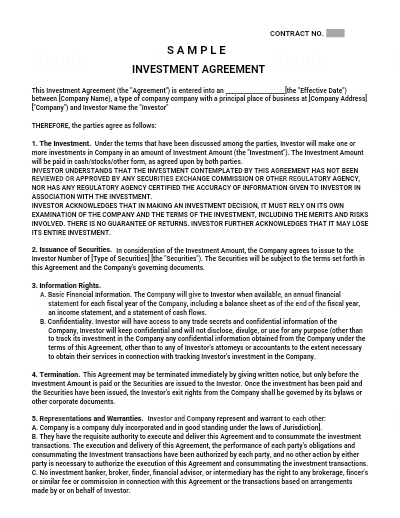

Part 1. Investment Contract Agreement Template

The investment contract agreement template can be a standardized document which defines the conditions and terms of an investment contract that involves two people. The template offers a simple outline for both the investor as well as the company can adhere to making sure that all the essential specifics are clearly defined and agreed upon. With the same template both sides can reduce time and prevent any miscommunications.

Key Components to Include in an Investment Contract Agreement Template

A properly-structured investment contract agreement template must include a number of essential elements.

Introduction of Parties

The section identifies the person who is investing and the business that are part of the contract, and provides basic information about the of the parties.

Investment Amount

The amount is clearly stated in the funds being invested. It also defines the nature of the investment such as debt, equity or a mix of both.

Equity and Ownership

Provides the exact amount of equity or ownership that investors will get as a reward for investing. It is important that the investor aware of the structure of ownership.

Rights and Responsibilities

The law outlines the rights and obligations of the investor including voting rights and access to financial information in addition to the obligations of the company, like how funds are used.

Confidentiality

A confidentiality clause is included to safeguard sensitive information in the process of investing. It helps to maintain confidence between the two parties.

Terms of Repayment or Return

This section explains when and how an investor should expect an investment return in dividends, interest payment and eventually the disposal of shares.

Termination and Exit Strategy

The clause outlines the conditions upon that the agreement may be terminated as well as the choices that the investor has to withdraw from the deal. It could be selling the shares either to the firm or other parties.

Dispute Resolution

The procedure for solving any dispute that could occur, including the arbitration or mediation process. It is important to have a clearly defined procedure to handle disputes.

Benefits of Using a Standardized Investment Contract Agreement Template

The use of a template for an investment contract provides numerous benefits:

- Efficiency:Templates provide an already-designed structure that is easily customized to match the particulars of the contract. This can save time and effort as opposed to writing the agreement by hand.

- Clarity:Incorporating the essential components in a template, it ensures the conditions of investment are clearly and complete which reduces the possibility of misinterpretations.

- Legal protection:The well-written investment contract agreement template can safeguard the interests of each party by clearly defining the rights and obligations of each party. The clarity of the law can avoid the possibility of future disputes as well as bring the foundation needed to the relationship between investors.

- Consistency:The use of a standard template will ensure that investment agreements are in an identical format. This makes the agreements easier to read and to compare.

- 100% secure

- 100% secure

- 100% secure

Part 2. Angel Investment Agreement Template

Angel investors are someone who invests in startups or smaller companies to purchase the right to own equity and convertible loans. They are usually able to step into the picture when conventional financing options including bank loans and venture capital aren't accessible to businesses. Investors play an essential role in aiding early-stage companies by providing more than simply funding: they also offer valuable guidance, connections to industry resources, and advice that is often lacking from private equity firms alone.

Specific Terms and Conditions to Include in an Angel Investment Agreement Template

An angel investment agreement template must clearly outline all conditions and terms pertaining to an investment. Important elements include:

Investment Amount and Equity

The amount is the sum of money the angel investor has invested as well as the proportion of ownership or equity that they get in exchange.

Milestones and Use of Funds

Specific milestones that the company must complete as well as how funds will be spent. It ensures that the investment is used energetically for the development of the business.

Valuation of the Company

The current value of the business at the moment of being agreed on the terms. This is helpful in determining percentage of equity for the investor.

Investor Rights

It includes the right to vote, seats on boards as well as access to financial data. This gives the investor the ability to control the operations of the company.

Exit Strategy

The article outlines the options available to investors who are angel investors, like selling shares in the process of acquiring, public offering or buying back shares. The investor can clearly see how to earn a profit from the investments.

Confidentiality and Non-Compete Clauses

Include provisions that safeguard confidential information shared between investors and businesses. It ensures that private information of the business is protected.

Protection for both Parties by a Angel Investment Agreement Template

The angel investment agreement template is created to safeguard both the investor and beneficiary. The investor assures them that their contribution is accepted and grants the investor with certain rights as well as an explicit exit plan. The business defines the conditions under which the business receives funding as well as ensuring there aren't any misunderstandings regarding how the funds are used and the involvement of the investor within the company.

With together the angel investment agreement template that both parties are able to invest with clear expectations as well as legal safeguards which can benefit to create a positive and successful business partnership. This template can be useful tool for securing the required capital to grow and ensuring both the company and the investor are secure.

- 100% secure

- 100% secure

- 100% secure

Part 3. Equity Investment Agreement Template

Equity investments involve the investor providing money to an organization by way of ownership shares. Equity investments differ significantly from loans in that their returns depend on how profitable the company becomes and therefore align with investors' interest in its success. Loan investors need only pay back interest over time; investors in equity investments gain returns tied to its success instead.

Key Clauses to Include in an Equity Investment Agreement Template

An effective equity investment agreement template should include key clauses designed to promote transparency and protect all parties involved:

Investment Amount and Equity Allocation

Be sure to state clearly the sum of money being put into the fund and what percentage of equity that the buyer will get in exchange. This information is vital in establishing ownership stakes.

Valuation and Share Pricing

In detail, the valuation of the company's present and also the value per share at the time of investing. This will benefit determine the fair value of shares being sold.

Use of Funds

Indicate how the funds are used by the company. The money is used for actions that will benefit grow the business and increase the profitability.

Rights and Obligations of Shareholders

Define the rights of equity investors. This includes voting rights, access financial statements, as well as participation in key company decision-making. The clause guarantees that investors can have their say on the governance of the business.

Dividend Policy

Define the policy of the business regarding how profits are distributed. This covers when and how dividends will be distributed to shareholders and provide the necessary information regarding profit sharing arrangements.

Exit Strategy

Provide the various options for investors looking to get out of their investments by way of public offerings, mergers and buybacks, acquisitions. This will give investors an idea of the ways they could get a return on the investments.

Dilution Protection

Make sure that there are provisions in place to safeguard investors from being diluted in stake in subsequent financing rounds. So, the equity stake of investors does not get reduced unfairly.

Confidentiality and Non-Compete Clauses

Secure sensitive information about business as well as stop investors from participating with competitors. This protects the business's rights and confidential data.

Importance of Clearly Outlining Ownership Percentages and Profit-Sharing Arrangements

When creating an equity investment agreement template, it is vital to outline clear profits-sharing and ownership percentages. Clarity helps avoid disputes and makes sure that all parties are aware of their legal rights and obligations. In stating explicitly, the amount of equity held by each investor and the method by which profits are divided, the contract promotes confidence and transparency.

The percentage of ownership determines how much degree of control and influence the investors enjoy on the decisions of the business. Profit-sharing agreements specify the manner and when investors can receive dividends on their investment essential for maintaining the trust of investors and their satisfaction.

An organized equity investment agreement template creates a solid basis to the relationship between investors to assure that all participants agree on their goals as well as their contributions to the firm's growth.

- 100% secure

- 100% secure

- 100% secure

Part 4. Real Estate Investment Agreement Template

Real estate investment refers to buying properties and renting them out for profit-seeking reasons. They can offer additional regular income via rental installments and could increase the value of property over the course of time. Real estate investments offer investors an ideal way to diversify their investments while taking advantage of tax breaks; making this investment opportunity attractive and appealing to many individuals.

Specific Terms to Include in a Real Estate Investment Agreement Template

An effective real estate investment agreement template should include essential terms designed to protect both parties: an owner and investor alike.

Property Details

It is essential to clearly describe the property that you are involved in the investment, including its place of residence, the type of property, as well as the relevant legal description. This will assure that the participants are in the same boat about the property being invested in.

Investment Amount and Ownership Structure

Indicate the sum to be invested. Then, describe the ownership structure. This includes the ownership percentage for each of the parties. This will clarify the financial contribution as well as stakes in equity.

Use of Investment Funds

Define how investment funds can be utilized to purchase the property, renovating it, or for operational costs. This allows for complete transparency when it comes to the handling of capital invested.

Profit Distribution

Define how the earnings, like rentals or profits from the sale of property, are divided among investors. This will assure a clear comprehension of financial results.

Management Responsibilities

Define who will be accountable to manage the property for tasks such as maintenance, tenant relationship and financial reports. This can benefit prevent confusions regarding the operational responsibilities.

Exit Strategy

The process of selling the property or transfer of ownership rights. This is a simple way for investors to earn a profit from their investments.

Risk Management

Incorporate provisions to address possible risks like the effects of market volatility, property damage or tenant-related issues. This helps reduce uncertainties and helps protect your investment.

Importance of Addressing Property Management Responsibilities and Potential Risks

When creating a deal for investment in real estate template for an agreement It is essential to define the responsibilities of property management and dangers. Determining who is responsible for managing the property will ensure that everyone is aware of the responsibilities and roles which reduces the possibility of conflict. A well-organized real estate investment agreement template is essential to warrant the value of your property as well as ensuring steady earnings from rental.

Furthermore, the description of risk factors and the way they can be handled will protect the investment from unanticipated issues. It could include requirements for insurance as well as contingency plans for vacant properties as well as strategies to handle repair and maintenance. In addressing these issues within the real property arrangement template the investors are able to protect their interest and increase chances of success with their investment.

A thorough real estate investment agreement template is not only a precise framework for purchase, but also aids in establishing trust among the parties in facilitating a smooth and profitable process of investing.

- 100% secure

- 100% secure

- 100% secure

Part 5. How to Customize Your Planner Template Using AfirstsoftPDF

Knowing how to utilize the investment agreement template is essential, however being able to modify it alike to your personal requirements is just as important. Follow this step-by-step procedure to benefit users customize any design template quickly.

Step 1: Download and Install AfirstsoftPDF

Start with downloading AfirstsoftPDF on your computer or Mac. After installation, open the program and then select the template you want to customize. Double-click on the template to open it.

Step 2: Edit the Template

Once you've opened the PDF file after opening it, choose Edit on the toolbar. This will open an editing frame that allows users to edit the text and modify various parts in the design. The AfirstsoftPDF's AI feature helps simplify this process by converting the entire PDF's template in simple words. This feature makes it easier to understand complicated sections and makes it simpler to edit the document's content without damaging the originality of the PDF.

Step 3: Save Your Customized Template

After you've finished making your changes to the template, simply click "Save". It will store all of the changes you made, creating an individual template that is ready to use.

- 100% secure

- 100% secure

- 100% secure

Part 6. Conclusion

Make use of investment agreement template is essential to ensure that the parties in the investment process are aware about their rights and obligations. These forms favor a clear and well-defined structure that prevents misunderstandings or disputes, and benefit ensure the smoothness of investment.

Investors and beneficiaries alike need legal guidance in drafting contracts in order to guarantee that the terms are legal and complete. A lawyer can benefit modify the agreement to meet the specific requirements and to comply with applicable laws.

A well-thought out and complete arrangement for investment provides many advantages, such as the protection of law, transparency and efficacy. With carefully-designed templates and collaborating with legal and other experts, investors can establish agreements without trepidation, and ensure profitable and mutually beneficial results.

- 100% secure

- 100% secure

- 100% secure